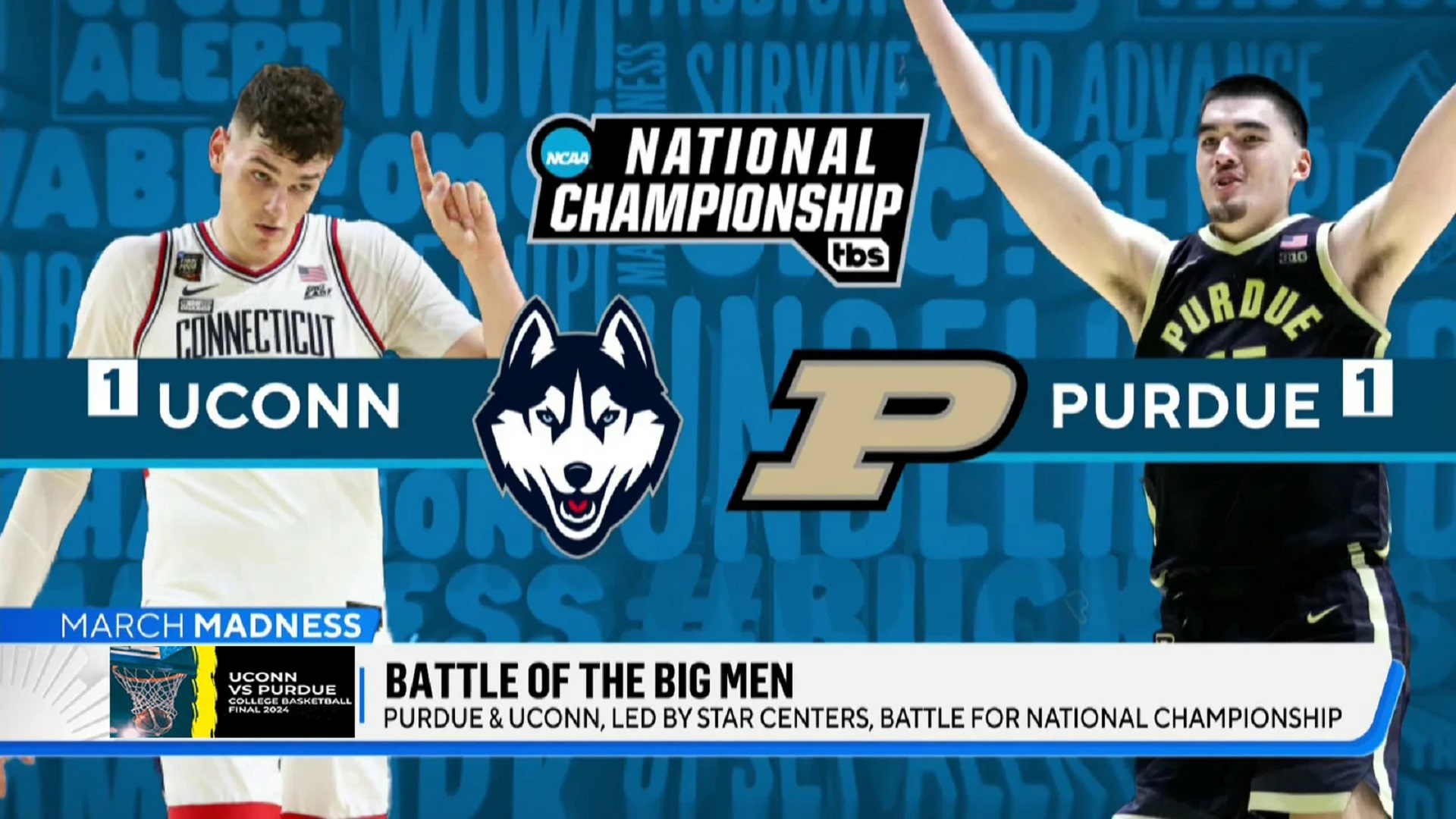

March Madness Men’s Final Livestream: How to Watch Purdue vs. UConn Live Online. The reigning NCAA champion UConn Huskies will look to defend their title on Monday when they face off with Purdue in the 2024 NCAA Tournament National Championship.

Connecticut and Purdue will compete for men’s college basketball’s most coveted prize Monday night in Glendale.

The Huskies and the Boilermakers are set for battle in the championship game of the 2024 NCAA Men’s Basketball Tournament. The defending champions returned to the sport’s biggest stage by fending off Alabama in the Final Four, while Zach Edey and company ended NC State’s Cinderella run Saturday night.

Dan Hurley’s side is a 6.5-point favorite at FanDuel Sportsbook. The Huskies are looking to become the first back-to-back champion in men’s college hoops since 2007, while the Boilermakers will try to win their first title in program history.

Here’s how to watch the UConn-Purdue game:

When: Monday, April 8 at 9:20 p.m. ET

TV: TBS

Live Stream: TBS

Connecticut is one win away from back-to-back national championships, while Purdue hopes to win their first NCAA Tournament tonight

The NCAA men’s basketball national championship game is finally here, capping off an action-packed March Madness season. No. 1 seeds Connecticut and Purdue square off in Glendale, Arizona tonight at 9:20 p.m ET. It’s a rare top matchup that features two of the biggest names in the league, Zach Edey and Donovan Clingan.

Connecticut is one win away from back-to-back national championships, and their sixth national title in total. If they win, they’ll be the first repeat national champion since Florida in 2006-07. Meanwhile, Purdue hopes to win their first NCAA Tournament on Monday night.

Whatever the outcome, it’s expected to be a good game thanks to UConn center Donovan Clingan and Purdue center Zach Edey who enter Monday’s game as two of the seasons most outstanding players and likely NBA lottery picks.

If the Huskies can win their second consecutive title it will mark the school’s sixth national championship in men’s basketball, with all of those coming since 1999.

All five starters finished in double figures for UConn in the Huskies’ Final Four win over Alabama, but their bigger test on Monday will be on defense as they will need to find a way to slow down Purdue’s Zach Edey, who is fresh off being named the Associated Press Player of the Year for the second year in a row.

Purdue (34-4) suffered a heartbreaking defeat as a No. 1 seed in the first round of last year’s tournament, but the Boilermakers are now just one victory away from finding redemption in the form of a national title.

Led by Edey, Purdue has looked nearly unstoppable in tournament play. The big man has scored at least 20 points in every tournament game and he posted a career-high 40 points in the Boilermakers’ win over Tennessee in the Elite Eight.

If Purdue can complete its redemption tour, it will be just the second team to ever rebound from losing to a No. 16 seed in the NCAA tournament by winning the national title the following year.

March Madness ends today with No. 1 UConn taking on No. 1 Purdue for the men’s college basketball national championship.

Tonight’s national championship between No. 1 UConn and No. 1 Purdue has an old-school feel to it. In an era where guard play and the three-point shots have dominated college basketball, the headliners of tonight’s game are neither ball handlers nor long-distance shooters but are big men who live in the lane and protect the rim. Centers Zach Edey of Purdue and Donovan Clingan of UConn are leading the pre-game chatter.

Edey, a 7-foot, 4-inch senior and back-to-back player of the year, has averaged 28 points, 15.4 rebounds and 1.8 blocks per game during the tournament. He has looked unguardable at times as he’s overpowered smaller opponents, but he’ll have someone nearly his size guarding him tonight. Clingan is a 7-foot, 2-inch sophomore who isn’t as much of a focus on offense for UConn as Edey is for Purdue, but he has been elite on the defensive end, averaging 3.6 blocks per game in the tournament.

UConn is seeking to become the first school to repeat as national champions since Florida in 2006 and 2007. Purdue is hoping to follow the path of Virginia, who became the first No. 1 seed to lose in the first round to a 16 seed in 2018 and then turned around and won the national championship as a No. 1 seed the following year. Purdue became only the second No. 1 seed to lose in the opening round when it was ousted by Fairleigh Dickinson last year, a loss that likely played a large role in Edey foregoing the NBA draft and returning for his senior season.

Men’s March Madness ends tonight with the crowning of the 2024 national champion. No. 1 UConn is aiming to become the first team in men’s college basketball to repeat as championship since Florida did it in 2006-07. No. 1 Purdue is hunting its first national championship in program history.

UConn played its worst game of the tournament against Alabama and still won by 14 points. The Huskies are an intimidating bunch. Purdue can counter with Edey in the middle and an experienced backcourt. While Edey vs. Donovan Clingan is the marquee matchup, this game will be determined more so by whether the Boilermakers can defend the perimeter and limit the Huskies’ open looks. In a game that looks tight on paper, UConn has more room for error and could put together another double-digit win.

Getting the no-doubt top two teams of this season to meet for the national championship is enough to make Monday night must-see TV. Adding in this matchup of big men might make this one of the most exciting pairings in recent NCAA men’s tournament history. Edey is the most decorated player in program history. The two-time Naismith player of the year stands with Bill Walton and Ralph Sampson as the only multiple winners in the award’s history.